Effortless Payroll, Accurate & On-Time Every Time

Automate salary processing, tax calculations, and compliance with Rednote Payroll Software. Ensure error-free payroll, timely payments, and seamless HR operations—all in one powerful solution.

Why Choose Rednote HR Payroll Software?

Latest Features

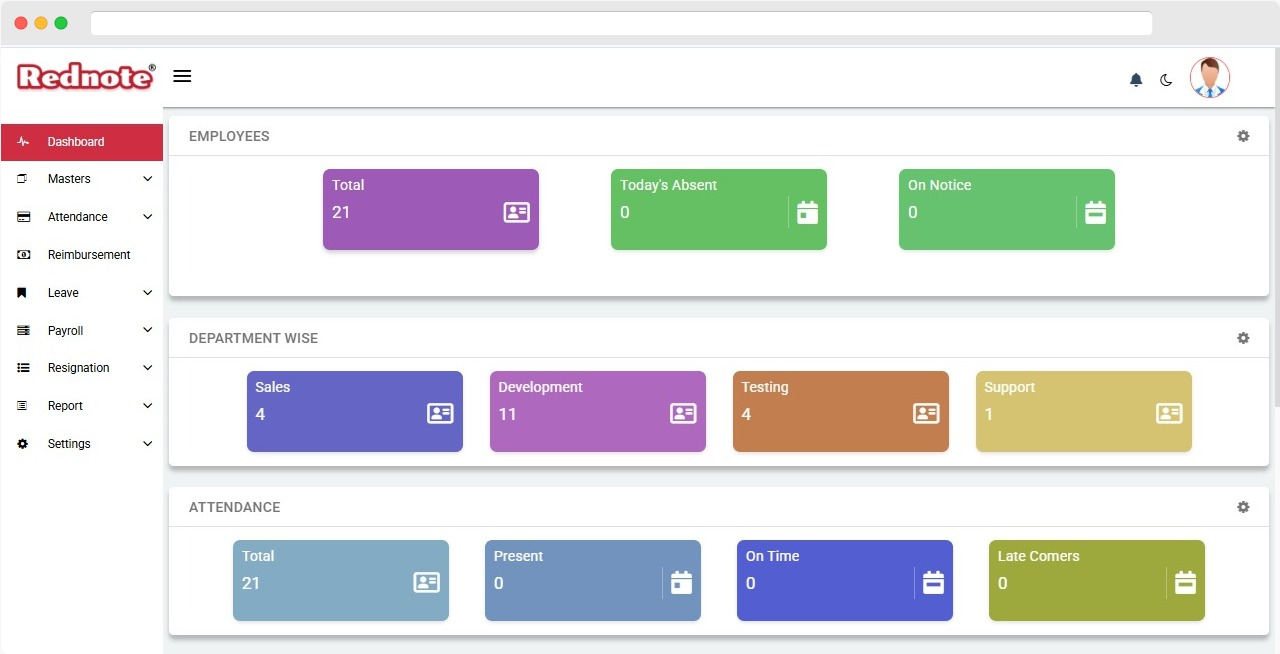

Attendance

Monitor employee attendance with real-time tracking, biometric integration, and automated reporting. Reduce manual errors and ensure accuracy with features like shift scheduling, late arrivals, early departures, and absence tracking.

-

Real-time tracking of employee attendance.

-

Biometric and RFID integration for accuracy.

-

Shift scheduling and attendance policies.

-

Automated reports for HR and payroll.

-

Identify Late arrivals, early departures, and absences.

Leave Management

Simplify leave tracking with an intuitive system that manages requests, approvals, and leave balances. Employees can apply for leave, view entitlements, and track approvals, while managers can automate leave policies, track absenteeism, and ensure proper workforce planning.

-

Easy leave requests and approvals.

-

Customizable leave categories and rules.

-

Automated leave balance calculations.

-

Holiday calendar integration.

-

Real-time leave tracking.

Overtime Tracking

Ensure accurate overtime calculation with automated tracking of extra working hours. Employees can log overtime, managers can approve requests, and HR can generate reports for compliance and payroll adjustments

-

Automatic overtime calculation based on work hours.

-

Customizable policies for overtime pay.

-

Approval workflow for managers.

-

Integration with payroll for seamless processing.

-

Different Salary Wages eg.1X or 2X per Hour.

Reimbursement

Simplified employee expense claims with a hassle-free reimbursement system. Employees can submit claims with receipts, managers can approve or reject them, and finance teams can process payments seamlessly.

-

Easy claim submission with receipt uploads.

-

Automated approval workflows for faster processing.

-

Custom categories and spending limits.

-

Transparent tracking of reimbursement status.

-

Employee Level Spending Limit.

Salary Advance

Automate deductions in payroll cycles to avoid manual errors, ensuring smooth financial management while supporting employees during urgent financial needs. Manage salary advances effortlessly with a structured system that tracks requests, approvals, and deductions.

-

Automatic deduction from future payroll cycles.

-

Digital tracking of advance history.

-

Easy configuration for advance recovery.

-

Monthly & Bimonthly recovery mode.

-

Skip advance repayment when payroll generation.

ESS Portal

Impress your employees with a self-service portal for seamless access to payslips, leave applications, tax declarations, and profile updates. Reduce HR workload by enabling employees to check attendance, request reimbursements, and track approvals in real time.

-

Employees can access payslips and tax declarations.

-

Self-service leave requests and approvals.

-

Profile updates and document uploads.

-

Secure access with role-based permissions.

-

Reduces HR workload with automated processes.

Statutory Compliance

Ensure payroll compliance with automated tax calculations, provident fund (PF), employee state insurance (ESI), professional tax, and labor law adherence. Stay updated with the latest legal requirements, generate statutory reports, and avoid penalties.

-

Automated tax, PF, ESI, and professional tax calculations.

-

Compliance with labor laws and government regulations.

-

Prebuilt statutory reports for audits.

-

Regular updates to meet legal changes.

-

Reduces risks of penalties and compliance issues.

Advance Reports

Gain valuable insights with powerful, customizable payroll and workforce reports. Track salaries, deductions, overtime, leave, and compliance metrics in real time. Export reports in multiple formats and analyze trends to improve decision-making.

-

Generate payroll, leave, and attendance reports.

-

Customizable dashboards for analytics.

-

Export reports in multiple formats (Excel, PDF, CSV).

-

Track compliance and financial summaries.

-

Automate reporting for audits and management.

Industry-Specific HR Payroll Solutions

Banking & Finance

Streamlined HR solutions for banking and finance.

Healthcare

Streamlined HR solutions for Pharma & Healthcare.

Technology & Services

Innovative HR solutions for Technology and Services industries.

Manufacturing

Smart HR Solutions for the Manufacturing Industry

Retail

Discover tailored HR solutions for the retail industry

Automotive

Discover tailored HR solutions for the Aautomotive industry

Education

HR solutions for streamlined education workforce management

Real Estate

Discovered tailored HR solutions for the Real estate industry

What Our Client Say's

Our Clients

General frequently asked questions

Explore our FAQs for quick and clear answers to your most common queries.

Choose Pricing Plan

We Provide Global Standard Pricing Packages

Free

0/Year

- Up to 5 Employees

- Employee Management

- Leave Management

- Attendance Tracking

- Biometric Device Integration

- Reimbursement

- Automated Payroll

- Salary Advance

- Overtime Tracking

- Holidays

- Income Tax Declaration

- Salary Revision

- Payslip Generation

- ESS Portal

- Employee Resignation

Standard

50/employee

Rs.600/employee/Year

- Employee Management

- Leave Management

- Attendance Tracking

- Biometric Device Integration

- Reimbursement

- Automated Payroll

- Salary Advance

- Overtime Tracking

- Holidays

- Income Tax Declaration

- Salary Revision

- Payslip Generation

- ESS Portal

- Employee Resignation

Refund Policy

Get your 14 days Free Trial

Latest From Our Blog

What CRM software is best for a small startup?

For a startup, the best CRM software needs to be simple to purchase, simple to implement, and scalable as your company expands. You need something that allows you to manage leads, monitor contacts, auto-follow up, and monitor your sales pipeline

Read More

What are the best cloud ERP systems for small businesses?

A great cloud ERP system is essential to a small company that wishes to automate, track growth, and compete—at the cost of a complete IT department.

Read More

What is cloud-based manufacturing erp software?

Cloud manufacturing ERP software is a form of enterprise resource planning system that is distributed and maintained over the cloud so that companies can access and administer their main business processes, such as manufacturing, anywhere they have an internet connection.

Read More